Definition, Explanation and Examples

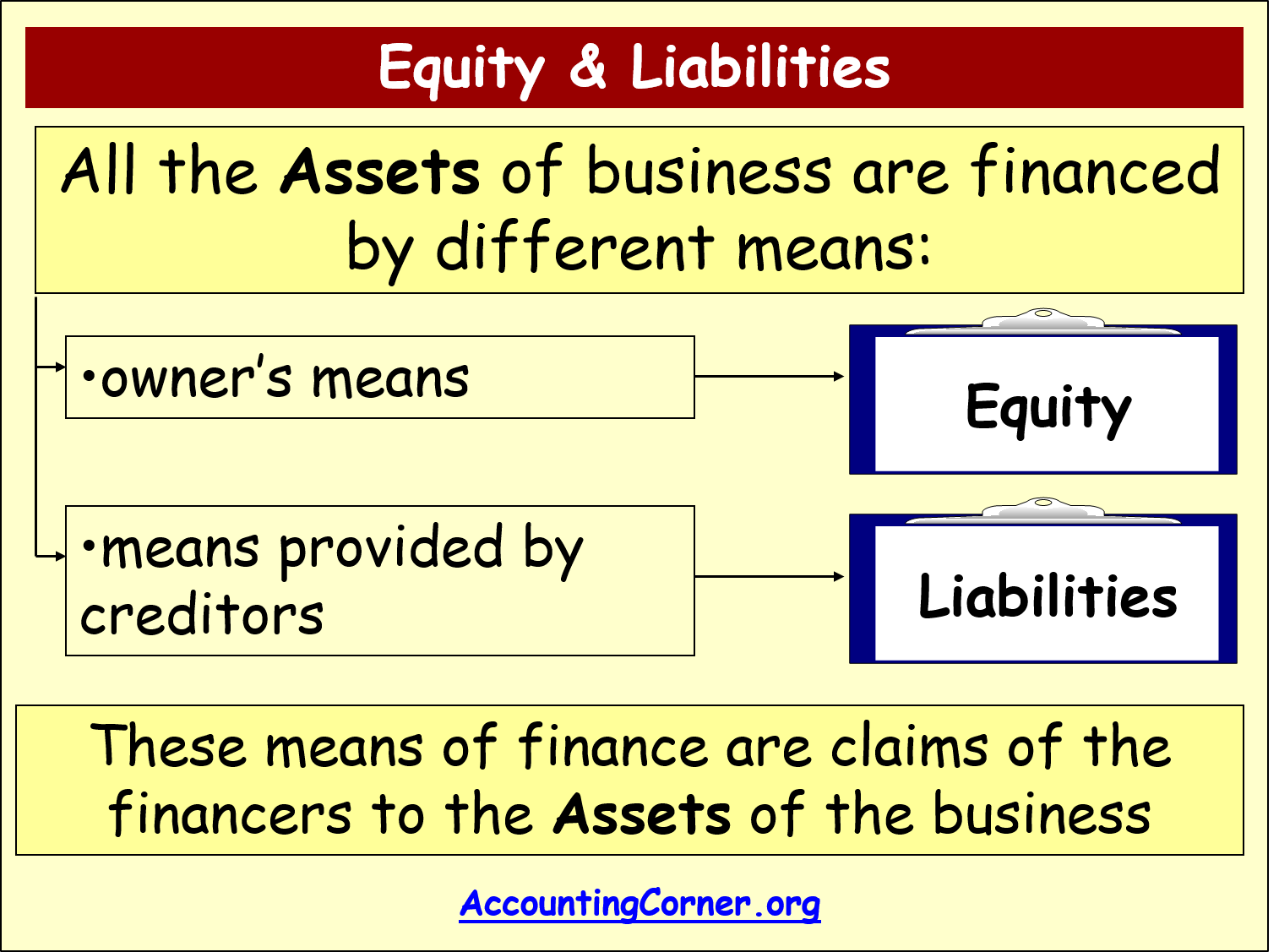

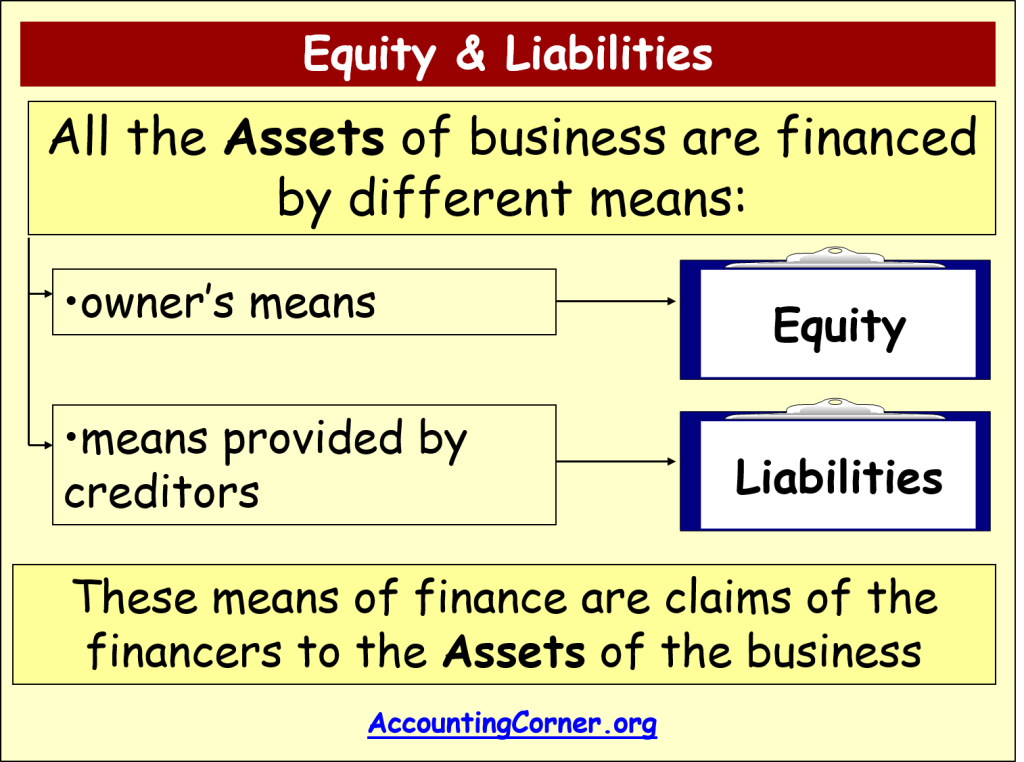

Liabilities are the amounts of money the company owes to others. Think of liabilities as obligations — the company has an obligation to make payments on loans or mortgages or they risk damage to their credit and business. Once all of the claims by outside companies and claims by shareholders are added up, they will always equal the total company assets.

Shareholders’ Equity

Required Explain how each of the above transactions impact the accounting equation and illustrate the cumulative effect that they have. Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash). Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation. However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization. Often, a company may depreciate capital assets in 5–7 years, meaning that the assets will show on the books as less than their “real” value, or what they would be worth on the secondary market.

4: The Basic Accounting Equation

The accounting equation is fundamental to the double-entry bookkeeping practice. Its applications in accountancy and economics are thus diverse. These are some simple examples, but even the most complicated transactions can be recorded in a similar way. This equation is behind debits, credits, and journal entries.

Components of the Basic Accounting Equation

Most sole proprietors aren’t going to know the knowledge or understanding of how to break down the equity sections (OC, OD, R, and E) like this unless they have a finance background. Still, you’ll likely see this equation pop up time and time again. Plus, errors are more likely to occur and be missed with single-entry accounting, whereas double-entry accounting provides checks and balances that catch clerical errors and fraud. Almost all businesses use the double-entry accounting system because, truthfully, single-entry is outdated at this point.

Do you own a business?

This transaction also generates a profit of $1,000 for Sam Enterprises, which would increase the owner’s equity element of the equation. At this time, there is external equity or liability in Sam Enterprise. The only equity is Sam’s capital (i.e., owner’s equity amounting to $100,000). The rights or claims to the properties are referred to as equities.

Ask a Financial Professional Any Question

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. For every business, the sum of the rights to the properties is equal to the sum of properties owned.

That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions. Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets. Assets pertain to the things that the business owns that have monetary value. Examples of assets include, but are not limited to, cash, equipment, and accounts receivable. This refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted.

- Liabilities are claims on the company assets by other companies or people.

- Net value refers to the umbrella term that a company can keep after paying off all liabilities, also known as its book value.

- The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities.

- The accounting equation relies on a double-entry accounting system.

In more recent years, this is being taught by the accounting equation to make students’ lives easier. Traditionally, this fact is represented in the “double entry bookkeeping” top 2019 networking events for accountants system starting with journal entries. Non-current assets are often written as “NCA”; current assets as “CA”; current liabilities as “CL… you get the idea.

This number is the sum of total earnings that were not paid to shareholders as dividends. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities. As a side note, this latter interpretation of the accounting equation is used more so in Finance vis-a-vis the former interpretation. Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. This arrangement can be ideal for sole proprietorships (usually unincorporated businesses owned by one person) in which there is no legal distinction between the owner and the business. For example, John Smith may own a landscaping company called John Smith’s Landscaping, where he performs most — if not all — the jobs.

Friday February 2nd, 2024

last modified: Friday December 20th, 2024